Face Amount Reviewed

Loading...

Loading...

Consulting

Unlock the potential for business success with our specialized management consulting services. We prioritize addressing our clients' most critical issues and seizing opportunities, providing tailored guidance to drive growth and achieve strategic objectives.

Life Expectancy Estimates

Discover the advantage of our comprehensive life expectancy estimates, combining traditional actuarial, underwriting, and IT functions. Make informed decisions in risk assessment and financial planning with accurate insights tailored to your needs.

Portfolio Evaluations

Optimize your portfolio's ROI with our comprehensive evaluation services. Our expert analysis helps manage risk and enhance performance, aligning your portfolio with your financial goals.

Digital Health Strategies

Discover the transformative power of new digital health strategies to elevate your business. Our expertise will guide you in leveraging cutting-edge technologies and optimizing operations, unlocking new efficiencies and driving success.

Expert Witness

Trust us for expert witness testimony services in longevity-related cases. Our experienced professionals provide comprehensive analysis and reliable opinions to support legal proceedings and ensure fair and informed decisions.

Medical Record Summaries

Access tailored medical record summaries promptly for informed decision-making and enhanced workflow efficiency. Our fast and efficient services transform extensive patient data into concise summaries to meet your specific requirements.

Celebrating a decade of excellence, Predictive Resources, LLC is a renowned independent consulting firm offering a comprehensive range of longevity, financial, IT, life insurance, and expert witness services. With 10 years of experience in the industry, we have established ourselves as trusted advisors, dedicated to providing exceptional solutions to our valued clients.

Our team of full-time actuaries brings unrivaled expertise, ensuring precise and insightful analysis tailored to your specific requirements. We specialize in accurate and reliable life expectancy estimates, enabling informed decision-making in areas such as risk assessment and financial planning. By leveraging advanced technologies, we streamline operations, improve accuracy, and drive efficiency in underwriting processes.

Choose Predictive Resources as your trusted consulting partner, and experience the unparalleled expertise and dedication that have made us a leader in the industry for the past decade. Let us help you unlock new opportunities, optimize underwriting processes, and achieve your business objectives with confidence.

Professional Approach

At the core of our services lies our unique and professional approach, reflecting our commitment to excellence in everything we do and the partnerships we cultivate.

Experienced Team

Our experienced team excels in actuarial, IT, and underwriting domains, delivering strategic guidance and cutting-edge solutions.

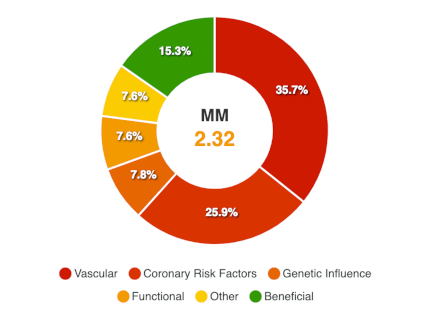

Life Expectancy Estimate

Our Life Expectancy Estimate is a comprehensive and data-driven assessment, ensuring accuracy and reliability. Skilled underwriters evaluate risk factors, supported by an underwriting manual and a rigorous double-blind audit system for consistent application of conditions. Utilizing decades' worth of data on the life settlement population, we have developed a sophisticated condition debit/credit model, using data regressions to pinpoint and adjust specific conditions. The same data was used to build our proprietary mortality tables that incorporate layers of secondary and underwriting anti-selections and mortality improvement, remaining accurate over time. As a final step, we consider comorbidities to prevent excessive debiting of conditions stemming from a single underlying issue. You can trust our report for a fair and balanced evaluation.

Accelerated Longevity Estimate

By using a medical history questionnaire/interview, our evaluation process is designed to cater to your specific target population. While the self-reported data we collect is not independently verified, it serves as a practical alternative in situations where a fully underwritten life expectancy estimate is not possible. To further enhance the accuracy of our assessments, we also integrate instantly available Rx, labs, and claims data. This valuable information allows us to confirm specific medical conditions and refine our evaluations. Rest assured, we will customize our approach to meet your unique needs and provide you with the most reliable results possible.

Rx/Labs/Claims Report

The Rx, Labs, and Claims Data Report is an invaluable resource that provides a detailed analysis of an insured individual's medication history, offering crucial insights into their pharmaceutical usage and treatment patterns. This comprehensive report offers a comprehensive overview of the individual's prescribed medications, dosage information, frequency of use, and related healthcare claims.

Vision Preview

We use AI to analyze medical records, providing you with an intuitive interface to easily access critical information and assess mortality risk. The advanced machine learning algorithms read and extract key details from the records, bookmarking specific conditions for quick reference. This streamlined approach enables efficient examination of disease progression, treatment effectiveness, and potential complications, empowering underwriters to make informed decisions.

Data Driven

Consistency

Mortality table and underwriting process are inextricable

Models

Longevity is Fluid

Population Mortality

To derive our mortality tables we start with U.S. population mortality, which gives us a baseline. Unlike traditional mortality tables used in the insurance industry, that are based on nearest age or age last, our formulaic tables account for continuous age.

Secondary Anti-Selection

We then reflect the impact of the insured’s decision to try to sell their policy. Our research has uncovered an anti-selection effect for those individuals. In other words, they tend to have lower mortality rates in the first several years than those who are keeping their life insurance policy.

Underwriting Anti-Selection

Next we account for underwriting anti-selection – which occurs at the time the original policy was purchased. This component recognizes that life insurance underwriting results in better mortality, the effects of the which wear off over time.

Mortality Improvement

It is widely known that the average person’s life expectancy is longer today than it was in the past. So what does that mean for our business? We must quantify the incremental shifts in standard mortality over time and account for it in our process.

We do this by applying a small factor based on age, gender, and smoking status to each of our tables that accounts for advances is medicine and other things that generally increase life expectancies over time.

Vincent Granieri

FSA, MAAA, EA, Founder, CEO

Granieri founded Predictive Resources in 2013 to ensure that the life expectancy provider space remained driven by sound analytics of relevant data. A fully credentialed actuary and Harvard MBA, Vince has over 40 years’ experience in life and health insurance, pensions and related fields, including over 30 years as a C-level executive and 15 years in life settlements. His research on senior mortality has been published and peer reviewed. He is responsible for scores of innovative improvements to forecasting life expectancy. He is known as a thought leader in life settlements, a pioneer in the application of predictive analytics to actuarial issues and a direct and candid leader.

Roger Tafoya

President, Chief Underwriter

Tafoya has over 30 years’ experience in the insurance industry, he has held various leadership and executive roles with carriers, reinsurers, and other market participants. In addition to his expertise in insurance, he is recognized as an innovative leader in the execution of digital health data strategies, including new data source integration with predictive models, algorithms, rule engines, and workflows. Before entering the insurance industry, Roger served as an Infantry Officer in the US Marine Corps, achieving the rank of Major. He has a bachelor's degree in history from Baylor University and has achieved several industry designations.

Gregory Heck

CIO

Heck has over 30 years of programming experience and is trained as a Six Sigma Black Belt, employing Lean/Six Sigma methodology for business development and analysis. As a strategist, Greg specializes in solution architecture, particularly in data mining and regression analytics. With expertise in financial, statistical, marketing, and end-user systems, he offers a unique skill set to our clients. Granieri and Heck co-authored a paper on senior longevity, which was presented at the Society of Actuaries' Living to 100 and Beyond Symposium, showcasing their industry knowledge and contributions.

Ryan Nelsestuen

CTO

Nelsestuen brings over 25 years of technology industry experience to our team. With a proven track record of driving business growth, Ryan led the development of innovative technology solutions. At Predictive Resources, he oversees technology development, from software engineering to AI. Passionate about leveraging technology to enhance customer experiences, Ryan stays up-to-date with industry trends. His extensive experience and comprehensive understanding of the technology landscape make him a vital asset to our leadership team. He has a bachelor's degree in Computer Science from the University of Wisconsin-Eau Claire.

The life expectancy (LE) provider industry faces challenges as new entrants use outdated methods, leading to artificially shortened life expectancies and misleading the market. Practices like misusing mortality tables and point estimates compromise accuracy, while many providers fail to follow Actuarial Standards of Practice (ASOP #48) in disclosing A/E ratios. This article highlights these issues and showcases Predictive Resources' transparent approach and exceptional A/E results.

Predictive Resources is excited to announce the launch of an enhanced Life Expectancy (LE) Certificate. This new tool exemplifies our commitment to leveraging advanced technology and client feedback to provide unparalleled insights into longevity risk.

EHRs are digital versions of a patient's paper records that contain a wide range of health information, including diagnoses, medications, and vital signs. This information is critical for determining an insured's life expectancy and risk profile, which are key factors in life settlement underwriting.

Predictive Resources, LLC is pleased to announce that Roger Tafoya has been promoted to President and Chief Underwriting Officer. Tafoya joined Predictive Resources in February 2019 as COO and Chief Underwriter.

In this episode, Mark Mrky and Rob Haynie chat with Vincent Granieri, CEO and Managing Member at Predictive Resources, LLC, to explore the potential of life settlements and how estimating your life expectancy plays an important role in the process.

A few months ago, Life Risk News published my commentary article regarding life expectancy (LE) apocrypha. Given the positive feedback I received, I decided to write a follow-up, focusing on industry suppositions about actual to expected analysis (A-to-E), no stranger to controversy over the years.

Uncover the real facts about predicting life expectancy in the life settlement market. Learn how old myths are being replaced by smarter ways to estimate mortality, avoiding past mistakes. See how medical history connects with today's errors and why using accurate methods matters.

I am very excited to be writing to you today, and since I am not announcing any price increases, you may be excited as well! May marks a particularly important milestone for Predictive Resources: our 10th anniversary! It is amazing to look back on our progress over the last decade, but none of this would have been possible without your support, encouragement, and feedback...